Federal Budget Australia 2022 – The Australian government has released its final Federal Budget before the election. It showed that it will spend $158 billion in taxpayer money over the next four years, with a particular focus on regional Australia.

The best news for voters is that if the government gets re-elected, they won’t have to pay any new taxes or fees. While this sounds like good news, hidden within the budget are some shocks for Australians.

Understandably, people are more concerned about how their personal financial situation will be affected than whether the government will save taxpayers billions of dollars in the future. We analyse the 2019 Federal Budget and its implications on household finance:

Federal Budget Impact: What does the budget mean for Australians?

The budget outlines the government’s financial plan for the next financial year. It’s a document that predicts revenues and expenses, showing the public exactly how their money will be spent. This is important because it allows voters to consider whether the proposed spending is necessary.

In recent years, the budget has become more partisan. The government has come under more scrutiny, with taxpayers keen to know how their money will be spent.

The opposition party will usually offer a budget alternative. This allows voters to compare the two and decide which party is best to manage the country’s finances.

The government’s budget has two main impacts on the Australian population. First, it sets out how individual taxpayers will be affected. This includes any changes to tax rates, Medicare and other services funded by the government.

Second, it sets out how the government will raise funds from taxpayers. This includes any new taxes that may be introduced or existing government fees that will be raised.

Power Bills to Rise 50 percent after Federal Budget Australia 2022

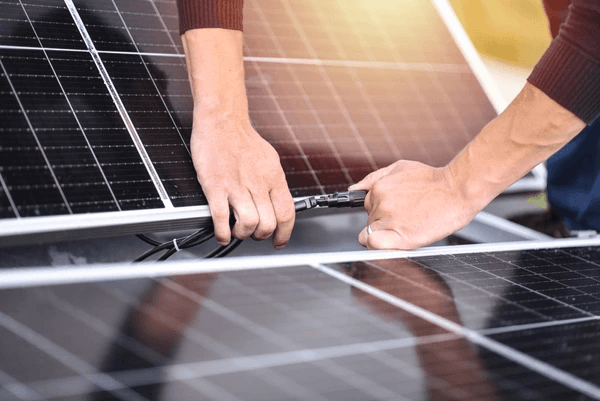

Australia is a country where people are used to paying high electrical bills. But electric rates are expected to increase by 50% over the next two years. The reason behind this is because of new government policies and charges for residential solar panels.

These costs are causing some homeowners to rethink their energy-saving measures. This will likely lead to more demand for electricity, which could result in higher bills for everyone.

The good news is that you can take steps to keep your power consumption down. For example, you can install solar panels on your roof and use energy-efficient appliances and lighting fixtures.

You can also install timers on your home’s appliances so that they turn on or off at certain times of the day or week. You can also adjust your thermostat if necessary.

By doing these things, you can help to lower your electricity bill and reduce your carbon footprint at the same time!

Taxes and Fees

The government will collect $50 billion in new taxes in the next financial year. This is an increase of $10 billion from the current budget. The biggest new taxes are the increase in the tobacco excise and the new sugar tax.

The tobacco excise will go up by $3 per packet, while the sugar tax will be set at $0.75 per 100 grams of sugar. While the tobacco excise has been increasing for the last decade, this budget brings it to its highest level.

However, the government claims this is primarily to raise revenue. It will also help to reduce smoking rates and save the budget billions in healthcare costs.

The government will also increase the Medicare levy. As part of its healthcare reforms, the government is increasing the levy. This will result in higher taxes for almost every Australian.

Health Care

The government has made major spending commitments to healthcare. The budget allocates $34 billion to Medicare. Another $3.9 billion has been allocated to the National Disability Insurance Scheme (NDIS). Another $1.4 billion has been allocated to mental health services.

While these initiatives are important for the country, they also increase costs for taxpayers. Medicare will be more expensive for everyone, while the NDIS and mental health services will require additional payments from taxpayers. The government has also made funding commitments to increase medical research.

The budget allocates $37 million to expand the National Medical Research Council. $50 million has been allocated to the Cooperative Research Centre program, while another $10 million will be spent on the Medical Research Future Fund.

Australia’s Infrastructure Problem – and how we’ll fix it

Australia faces a $152 billion infrastructure shortfall. The government has already committed $75 billion to infrastructure projects. However, it still has to find an additional $77 billion. To find the money, the government will sell off the remaining shares in the government-owned businesses.

The government owns a number of businesses, including Australia Post, the Commonwealth Bank and the Future Fund. It’s committed to selling a number of these businesses. The budget has committed $2 billion to expanding the Snowy Hydro scheme.

The scheme involves the construction of new dams and turbines, providing much-needed power to the eastern seaboard. The government has committed $4 billion for the Northern Australia Infrastructure Facility, which will be used to finance new infrastructure in northern Australia.

The government has also committed $5.9 billion to the Australian Rail Track Corporation, which owns and operates the country’s rail network.

Defending Australia

The government has committed $10.2 billion to defense spending for the next financial year. This includes $4.2 billion for the Australian Defence Force and $6 billion for the Department of Defence.

This is a slight decrease from the current budget. However, it’s more than the $3.8 billion allocated in the last budget before the last election. The government is committed to maintaining Australia’s defense spending as a percentage of GDP.

This means we’ll spend more money on defense. In particular, the government has committed $5.6 billion to the Joint Strike Fighter project.

This is a program to acquire advanced fighter jets for the Australian Defence Force.

Support for Solar Industry Jobs and Training The Federal Budget recognizes the potential of the solar industry as a significant source of employment and economic growth. It may allocate funds to support job creation and training programs within the solar sector. This investment not only stimulates job opportunities but also builds a skilled workforce equipped with the expertise to design, install, and maintain solar energy systems, fostering the growth of a robust and sustainable solar industry.

Investment in Regional and Remote Solar Initiatives

To ensure the equitable distribution of solar energy benefits, the Federal Budget may prioritize investments in regional and remote areas. These initiatives aim to address energy inequality by extending access to clean and affordable solar power to communities that may have limited access to traditional electricity sources. By investing in solar initiatives in these regions, the government promotes energy independence, economic development, and improved living conditions.

Regulatory Framework and Standards for Solar Installations

The Federal Budget may allocate resources to establish or enhance the regulatory framework and standards for solar installations. This ensures the safety, quality, and reliability of solar energy systems, protecting consumers and encouraging confidence in solar technology. By setting clear guidelines and enforcing compliance, the government fosters a thriving solar industry and safeguards the interests of all stakeholders.

Collaboration with Industry and Research Institutions

The Federal Budget emphasizes collaboration with industry stakeholders, research institutions, and academia to drive solar energy innovation and deployment. By fostering partnerships, sharing expertise, and facilitating knowledge transfer, the government strengthens Australia’s position as a leader in solar technology. Collaborative efforts enable the development of cutting-edge solutions, advancements in solar research, and the creation of a supportive ecosystem for the solar industry.

Long-Term Commitment to Renewable Energy

Transition Lastly, the Federal Budget demonstrates a long-term commitment to the transition towards renewable energy, including solar power. It sets the stage for sustained investments, policy stability, and ongoing support for solar energy initiatives. This commitment sends a positive signal to investors, businesses, and the community, fostering confidence and attracting further private investment in the renewable energy sector.

As the Federal Budget unfolds, it is essential to closely monitor the specific measures and allocations related to solar energy. By capitalizing on the opportunities provided by the budget, Australia can accelerate its transition to a cleaner and more sustainable energy future, powered by the abundant potential of solar energy.

Public-Private Partnerships for Solar Investment

Recognizing the importance of private sector participation in driving solar energy growth, the Federal Budget may emphasize public-private partnerships. These partnerships encourage collaboration between government entities and private companies, leveraging the expertise and resources of both sectors. By combining government support with private investment, the solar industry can experience accelerated growth, increased innovation, and a more rapid deployment of solar energy infrastructure.

International Collaboration on Solar Energy

In an interconnected global energy landscape, the Federal Budget may prioritize international collaboration on solar energy initiatives. This can involve partnerships with other countries, sharing best practices, and participating in global forums and agreements. By working together on research, policy development, and technology transfer, Australia can contribute to the global transition towards renewable energy and gain insights from international experiences.

Conclusion

The budget outlines the government’s financial plan for the next financial year. It’s a document that predicts revenues and expenses, showing the public exactly how their money will be spent. This is important because it allows voters to consider whether the proposed spending is necessary. In recent years, the budget has become more partisan. The government has come under more scrutiny, with taxpayers keen to know how their money will be spent. The opposition party will usually offer a budget alternative.

This allows voters to compare the two and decide which party is best to manage the country’s finances. The government’s budget has two main impacts on the Australian population. First, it sets out how individual taxpayers will be affected. This includes any changes to tax rates, Medicare and other services funded by the government. Second, it sets out how the government will raise funds from taxpayers. This includes any new taxes that may be introduced or existing government fees that will be raised.